Awasome Insurance In Trading Account Ideas

Awasome Insurance In Trading Account Ideas. A trading account is essential to conduct transactions in stocks, commodities and other securities. Just answer a few questions about you, your business, and the type of.

A trading account is similar to a bank account administered by a stock broker, that allows a user to buy or sell securities. Trading account shows the result of trading operation of an enterprise whereas profit and loss account shows the overall result of the business as a whole. There are four types of trade credit insurance, as described below.

A Trading Account Is Debited With The Cost Of Goods Sold And All The Expenses Connected With The Purchase Of Goods And Credited With Sale Proceeds Of Goods.

A trading account is a nominal account in nature. Activities which generate revenue for the business, such as sales of services or goods, closing stock are shown on the credit. He/she can also invest in mutual funds listed in the national stock.

Investment And Insurance Open Demat And Trading Account Online Open A 3 In 1 Account With Idfc First Bank No Account Opening Charges No Amc For The First Year.

He was proposing that i. This week, my account manager contacted me explaining that due to the volatility of the trading market there was a high risk of me losing my investment. With more than 35 years of experience in trade credit, aig offers unparalleled local underwriting and policy servicing.

Accounts At Sipc Member Brokerages Qualify For Their Own $500,000 Of Protection When They Have.

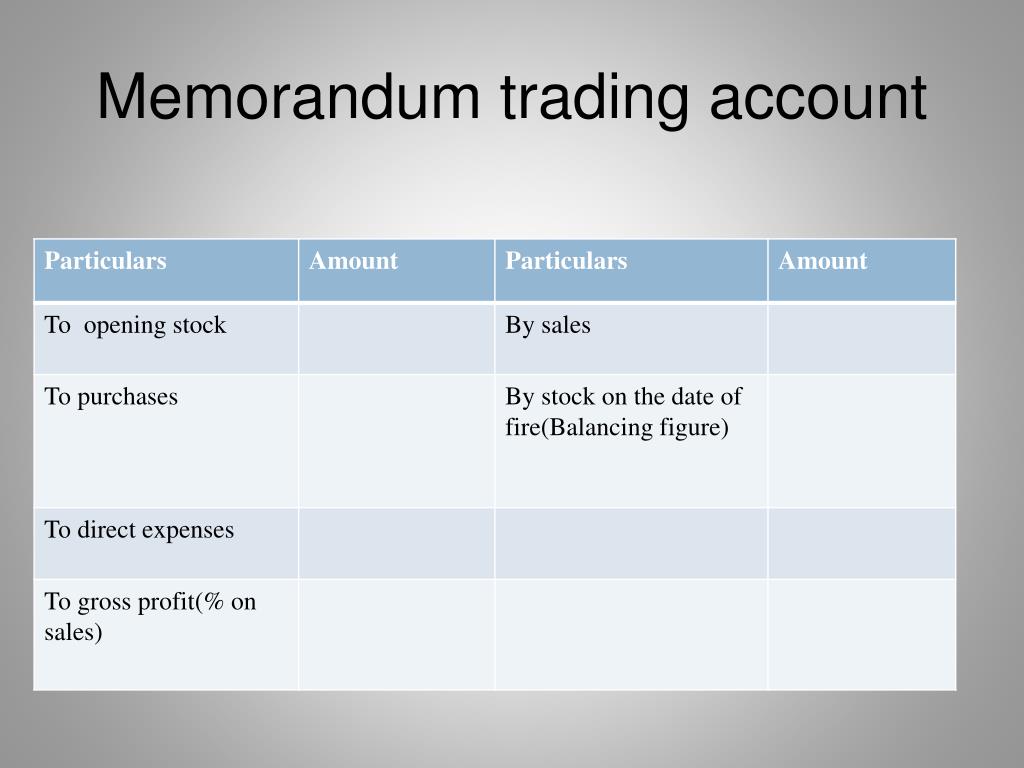

Trade credit insurance provides cover for businesses if customers who owe money for products or services do not pay their debts, or pay them later than the payment terms dictate. Investment losses or claims against bad advice are not covered. The trading accounting has the following features:

The Sipc Provides Up To $500,000 Of Protection, Which Includes Protection For Up To $250,000 In Cash.

In the trading account, the cost of goods sold is subtracted from net sales for the period to calculate gross profit. A trading account is similar to a bank account administered by a stock broker, that allows a user to buy or sell securities. You can buy or sell assets frequently through your trading account.

It Helps You Speculate Trades By.

It’s quick and easy to find and compare market traders’ insurance quotes with moneysupermarket. It is the first stage of final accounts of a trading concern. Trading account shows the result of trading operation of an enterprise whereas profit and loss account shows the overall result of the business as a whole.

Catat Ulasan for "Awasome Insurance In Trading Account Ideas"