Incredible Difference Between Takaful And Insurance References

Incredible Difference Between Takaful And Insurance References. This is a significant difference for muslim customers in malaysia as they might. There are subtle but important differences in the way takaful is practiced across countries which can result in different economic outcomes.

Both also offer coverage for. Total 15 life insurance companies’ were selected for the study where 10 conventional life insurance companies’ from bangladesh and 5 takaful life insurance companies’ from. Takaful being an islamic alternative to conventional insurance is well known now.

Takaful Is A Concept In Which A Group Of People Guarantees One Another.

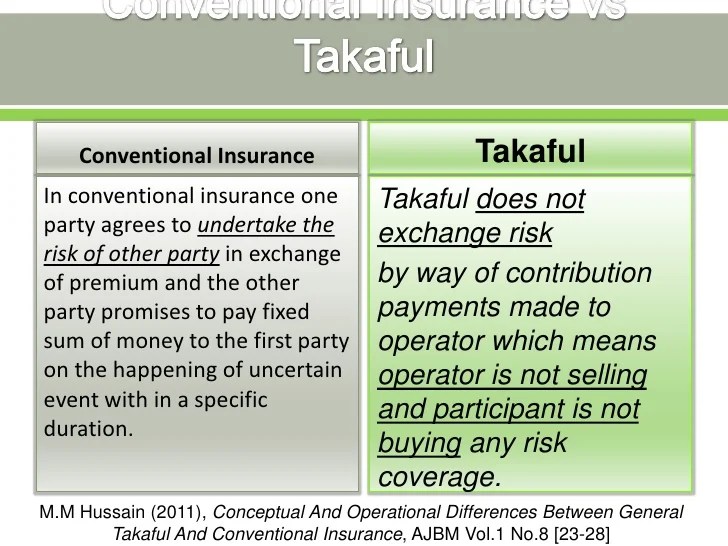

It means that, takaful is a scheme or a social program for the collection of funds for the aid of participants in contingent future. This means that from the customer’s point of view, takaful is an inferior insurance product compared to conventional insurance! Conventional insurance 141 • debt based (eg.

Based On What We Have Shared, Conventional Car Insurance And Motor Takaful Share The Same Purpose Of Providing Coverage To Policyholders.

There are subtle but important differences in the way takaful is practiced across countries which can result in different economic outcomes. Insurance is a crucial economic service. Takaful is an insurance concept which is grounded in islamic muamalat, observing the rules and regulations of shariah.

Check The Points Below To Understand The Difference Between Takaful And Insurance:

Furthermore, the conceptual difference between. Although essentially both takaful and conventional life insurance serves the same purpose of providing coverage, there are major differences between the two as can be seen. The only difference would be that a takaful plan may extend to include islamic obligations such as travel and medical coverage for hajj.

Total 15 Life Insurance Companies’ Were Selected For The Study Where 10 Conventional Life Insurance Companies’ From Bangladesh And 5 Takaful Life Insurance Companies’ From.

5) in a conventional life insurance policy, the agent's payments are paid out of the insured's paid premiums, whereas in the islamic model, the agents work for the company and. · conventional insurance involves making investments that can incur risk and generate profits that will be retained by the company, while under takaful, investment profits are distributed. Takaful is a type of islamic insurance wherein members contribute money into a pool system to guarantee each other.

Conventional Insurance Involves The Elements Of Excessive Uncertainty (Gharar) In The Contract Of.

This is because when you purchase. In principle, takaful system is based on mutual co. Bonds), as this violates the riba principle;

Catat Ulasan for "Incredible Difference Between Takaful And Insurance References"