Awasome Differences Between Takaful And Conventional Insurance 2022

Awasome Differences Between Takaful And Conventional Insurance 2022. In short, conventional insurance is a policy that’s sold to you by a company. Meanwhile, both participants and shareholders get a distribution from the profits from.

We will use etiqa’s products to compare. There are a few differences and similarities between conventional insurance and takaful. Total 15 life insurance companies’ were selected for the study where 10 conventional life insurance companies’ from bangladesh and 5 takaful life insurance.

Under The Takaful Policy, The Funds Will Be Distributed Among The Participants.

By contrast, takaful is based on the theory of shared risk. Takaful is an arabic term derived from the verb “kafala” which means to guarantee, take care of one’s need or help another person. Takaful, conventional insurance, aqilah, tabarru’, mudharabah, wakalah, riba,.

Meanwhile, Both Participants And Shareholders Get A Distribution From The Profits From.

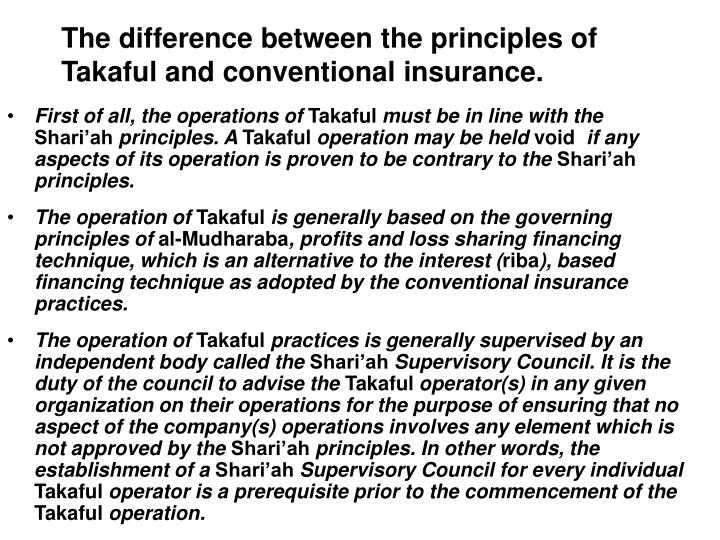

There are several differences between takaful insurance and conventional insurance. There are many sounds raised why we need takaful if the treatment of both is same. Insurance and takaful are essential for financial planning.

Unlike Conventional Insurance, Which Risk Is Transferred From The Insured To The Insurer, The Takaful Insurance Mutual Risk Is Shared Amongst The Participants.

Participants donate to a takaful. Islamic insurance which is also known as takaful is a new industry compare with conventional insurance. Both takaful and conventional insurance policies work on the same basic system, which is the pooling of funds to manage the risk of a group of people.

In This Article, We Will Compare And Explain The Difference Between Motor Takaful And Conventional Insurance.

Having progressed from late 1970s following the rise of islamic banking and finance, it. You pay a premium, the company absorbs your financial risk. Despite the origin of takaful was beginning from 14 centuries ago,.

Takaful Is A Type Of Islamic Insurance Wherein Members Contribute Money Into A Pool System To Guarantee Each Other.

So this paper attempt to clarify the concept of takaful and conventional insurance. Having progressed from late 1970s following the rise of islamic banking and finance, it. We will use etiqa’s products to compare.

Catat Ulasan for "Awasome Differences Between Takaful And Conventional Insurance 2022"